Get Started With

servzone

Overview

The amount of capital to invest in a company is one of the most important decision proponents when a company is in its corporate stages. As the business begins, the company may look to expand its operations in size, scale, or structure. To make that dream a reality, more money may be required in the company, basically an increase / change in the share capital of the company. Sometimes, the amount of capital required may exceed the limit of capital authorized at that time.

Authorized capital is the largest amount of capital for which a company can issue shares to shareholders. As per section 2 (8) of the Companies Act, 2013, the capital limit specified in the Memorandum of Association under capital closure is specified. A company may take the necessary steps necessary to raise / change the authorized capital limit to issue more shares. However, it cannot issue shares exceeding the authorized capital limit in any case.

meaning of share capital

The term capital refers to the 'share capital' of an organization where rupees are divided into a predetermined number of shares of a certain amount. Each company needs cash in the form of share capital to sustain the business. The organization uses cash to meet its requirement by the method of obtaining trading premises and stock-in-trade etc.

The company that has chosen to expand its capital should first examine the current authorized share capital. This is because the company cannot in any way give away the previous portion of the authorized share capital, issuing the shares requires the authorized share capital by changing the Memorandum of Association of the company.

A company holding share capital can revise share capital if authorized by Article of Association. In this case, the company is required to follow the technology recommended under the Companies Act, 2013. For increase / change in share capital, it is necessary to obtain the approval of the Registrar of Companies by filing the required form.

Meaning of authorized capital & Nominal Capital

The provision of section 61 governs the change in share capital in organizations, read with sections 13 and 64 of the Companies Act 2013. As per section 2 (8) of the Companies Act, 2013, 'authorized capital' or 'nominal' capital 'denotes such capital approved by the memorandum of a company which is the most important measure of the share capital of the organization.

Thus, it is clear that by employing the previously mentioned definition, an organization can increase its business to the level of authorized capital. If you need to expand your business in the temptation of more money, at that point, you will have to increase your approved capital after a few steps, as discussed further.

changes in share capital

- Share capital is a prerogative for a predetermined amount of share capital, with its specific rights and liabilities.

- According to the Sale of Goods Act, 1930 – Goods implies any movable property other than exceptional cases, money and stock and shares.

- Share capital is identified by its number, although this provision will not have a significant effect on the share held by a person, whose name is recorded as a holder in the records of a depository.

- Also, a part of any part of an organization is a movable asset of the company in the manner mentioned in the articles of association.

Types of changes in share capital

As provided in Section 61 of the Companies Act, 2013, various types of changes in share capital are linked.

They are as follows: -

- Share capital is identified by its number, although this provision will not have a significant effect on the share held by a person, whose name is recorded as a holder in the records of a depository.

- Also, a part of any part of an organization is a movable asset of the company in the manner mentioned in the articles of association.

What are the changes in share capital?

As provided in Section 61 of the Companies Act, 2013, various types of changes in share capital are linked.

They are as follows: -

- Increase in ‘Authorized’ Share Capital;

- All or any combination and division of share capital into shares of a larger amount than the existing share;

- Turn all or any of its fully settled stock into stock and convert that stock into a fully organized port of any division;

- Sub-division of its shares, into parts.

- Shortage of shares.

What are the broad types underlying share capital changes?

The types of changes in share capital under Section 61 of the Companies Act, 2013 are as follows: - Issued Share Capital

Issued share capital is that piece of approved share capital, which organization issues in overall for the membership. The organization issues ‘Issued share capital’ for public subscription, and the portion for which it is registered at the nominal worth.

Increased Authorized Share Capital

Share capital is the portion of a company's equity that is established by issuing shares and exchanging them in exchange for capital (cash or other events) to stockholders. Authorized share capital means the nominal capital with which the company was consolidated.

To maintain financial dignity, the government specifies that no company can issue indiscriminate shares to raise capital. For that result, authorized share capital is the maximum value of share capital that the company is legitimately authorized to issue to shareholders. The company can increase share capital by executing a change in the share capital clause in the Memorandum of Association.

Consolidation of share capital

The company can also fix changes in share capital by consolidating smaller classification shares into broader classifications. This should not be effective if changes and splits in the voting percentage of shareholders are seen, except that the tribunal does not confirm:

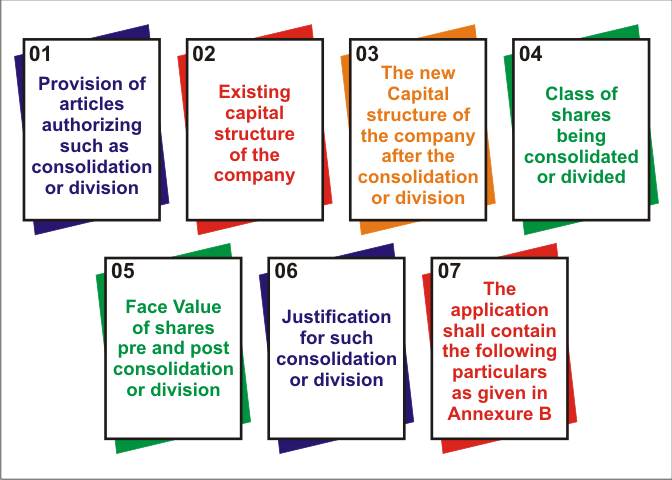

An application form with the details included in Annex-B should be filled in Form No. NCLT-1. The application should include the following: -

Conversion of share capital

For changes in share capital, the company can convert fully paid shares into stocks. Re-conversion of shares towards fully paid shares can also be done additionally. Conversion of debt into equity share capital Standard & Reliable model for raising capital without direct investment. Many times in order to conduct a smooth business in India, in that case, the loan is converted into share capital.

The Companies Act, 2013 has emerged with new provisions for conversion of debt into equity shares, and the same is included in section 62 (3) of the said Act. As per the provisions of Section 62 (3) of the Companies Act to convert debt into share capital, the company has to take a loan on the condition that the loan will be converted into share capital.

Further, if any such option is approved by special resolution before considering the loan; In such a case, the subscribed capital can be raised. It should be observed that passing special resolution is most valuable at the time of grant of loan. Also, if the company is denied a special offer; In that case the loan cannot be converted into share capital.

Sub-division of Share Capital

In this prototype, the company sub-divides its shares in a smaller amount than that of what established by the Memorandum of Association. "Subdivision of share certificates" means a separate document needed by a shareholder for a serving of his holding. This is where the shareholder demands a lesser number of shares than his or her shares. Considering Rule 6 (1) of the COM (Share Capital and Debentures) Rules, 2014, distributes capital through subdivision of share certificates.

Whenever there is a subdivision of shares, the company changes the composition of its share capital, respectively, by changing / increasing the number of shares issued and reducing the par value. As a result, the value of each share decreases, and the number of total shares develops. The range of shares and the entire amount of declared shares remain constant.

Cancellation of share capital

If no person takes a share, and / or reduces the amount of share capital by the number of shares, it is called cancellation of share capital. Share capital reduction means reducing the company's issued, subscribed and paid-up share capital. Earlier, the deduction of share capital was administered by sections 100 to 104 of the Companies Act, 1956. It is now governed by Section 66 of the Companies Act, 2013. According to the old act, it was subject to confirmation of the higher. The court, but under the new Act, the said officers of the High Court were transferred to the National Company Law Tribunal (NCLT).

Buyback of shares and redemption of preference shares is also a shortage of share capital, but is governed by specific provisions prescribed under the Act. Such deficiency in the form of buyback and recovery does not require approval / approval from the Tribunal (NCLT).

The company can reduce share capital by canceling any shares that are disallowed or unpublished by available assets. For example, if shares of face value of INR 100 represent each fully paid Rs. 75 value of property. In such a case, reducing the share capital can be effected by canceling the rupee. 25 per share and writing of common property.

Required Documents

They are as follows: -

- Announcement of EGM with descriptive statement.

- Duplicate of the resolution given at the general meeting of the associates

- Revised Memorandum of Association.

- Revised Articles of Association

- A valid certified copy of board resolution for changes to AOA

- A valid certified copy of the board resolution for changes to the MOA

- A valid certified copy of the shareholders' resolution

- Duplicate audited balance sheet of the last three years;

- Resolution to allow such consolidation or division and to provide clarification for equivalent

- The evidence of the new capital system consolidates or divides the credit and class of shares;

- Affidavit certifying the petition.

- Bank drafting of payment of request fee.

- A copy of the board resolution along with the applicable advocacy or memorandum, whatever is available as per requirement

- Two additional duplicates of the application

- Any other applicable document

procedure

A brief overview of the procedure for change in share capital is as follows:

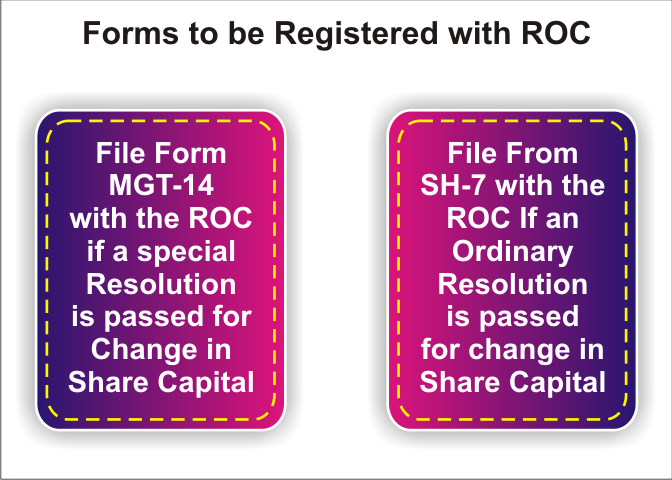

The above forms must be filed by the Ministry of Corporate Affairs along with the designated fee. If the forms discussed above are not registered with the Registrar of Companies (ROC), in those cases (Section 117 of the Companies Act, 2013) the company should be liable to fine which shall not be less than five lakh rupees and Can reach up. 25 lakhs to Rs. Every officer who is in default will be liable to pay Rs 1 lakh and can be increased to Rs 5 lakh.

Detailed steps to change share capital

servzone professionals will be at your disposal to assist in the process of changing your company's share capital. We will ideally plan and ensure the successful completion of the process.

- Authorization in Articles of Association

The article of the organization should have a system of approving it to increase its authorized share capital. If there is no provision in the article, servzone will assist you in revising your article of relationship as per the Clause 2 Companies Act 2013 arrangement.

- Board meeting

Notice of Executive Act will be given to all the top managerial employees as per clause 173 (3) of the Companies Act 2013. To assemble the Executive Assembly, the strategy would be:

1) Approval of officers for increase in approved share capital

2) The day, date, time and schedule of the organization to have an additional regular setting (EGM).

3) servzone will assist you in supporting the organization or one of the organization's secretaries, to notify you of the regular mobilization;

- Notice of EGM

Additional regular meeting, (EGM) will be communicated to all investors and officials of the organization.

- General Meeting

Organizing additional general general meeting of the organization on the chosen date.

- Notification to ROC

Subsequently, taking approval at shareholder meetings, servzone will help the company draft a converted MOA to convert it into share capital. A company has to inform / inform about the same by filing SH-7 with MCA. In addition, the form has to be submitted in 30 days from the date of the proposal.

- Form

servzone will be ready to file all your compliance such as MGT-14, which is required to be filed within 30 days of passing the resolution in the wider assembly. Form SH-7 also has to be filed within 30 days of passing the resolutions.

GST Registration

PVT. LTD. Company

Loan

Insurance